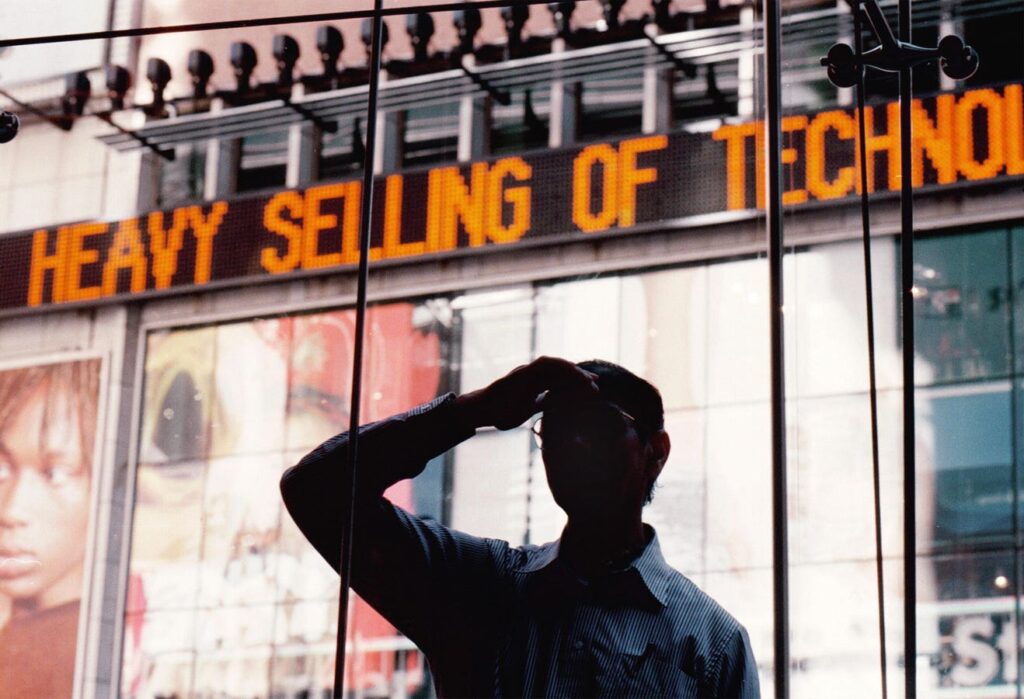

The S&P 500 fell 1.9% this week. The Magnificent Seven, comprised of Microsoft (MSFT), Meta… [+] Platform (META), Amazon.com (AMZN), Apple (AAPL), Nvidia (NVDA), Alphabet (GOOGL) and Tesla (TSLA) led the decline, down 4.8%.

Getty Images

The pace of earnings announcements accelerated last week, with 44 of the S&P 500 companies reporting earnings. Many of the companies reporting earnings were banks, which reported better-than-expected profits, helping to raise quarterly profit expectations for the banking sector. 80% of S&P 500 companies reported quarterly profits that beat expectations.

The second-busiest earnings season is upon us with 136 S&P 500 companies scheduled to report earnings for the second quarter. A more detailed earnings season preview can be found here. Companies scheduled to report include Coca-Cola (KO), Tesla (TSLA), Visa (V), Alphabet (GOOGL), Union Pacific (UNP), Norfolk Southern (NSC) and AbbVie (ABBV).

S&P 500 Earnings Season

Glenview Trust, FactSet, Bloomberg

The S&P 500 fell 1.9% for the week. The Magnificent 7, comprised of Microsoft (MSFT), Meta Platform (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL) and Tesla (TSLA), led the decline with a 4.8% drop. Learn more about the Magnificent 7 traits here. The recent weakness of the Magnificent 7 stocks is largely due to second-quarter earnings expectations. Most stocks are expected to outpace the S&P 500 in revenue growth, and the two biggest laggards since July 9th are Meta (META) and NVIDIA (NVDA), which are expected to have the highest year-over-year revenue growth.

The Magnificent 7: Estimated Q2 Earnings Growth (YoY)

Glenview Trust, Bloomberg

More notably, the rotation that began on July 9th continued, with large technology stocks taking a breather and weighting the index more heavily, while smaller companies fared better: Small caps rose 7.7%, while the Magnificent 7 and S&P 500 fell 7.3% and 1.3%, respectively. Equity market breadth improved markedly, with the S&P 500 up 3.6% since July 9th after the average declined in the second quarter.

Market Returns

Glenview Trust, Bloomberg

Defensive stocks, which are less exposed to the economy, performed better than cyclicals, which are more exposed to the economy.Still, the move reversed a surge in cyclicals following last week’s rate-cutting-friendly inflation report.The strong performance of banks and small-cap stocks is another sign that the market is still not worried about recession risks.

Cyclical vs. Defensive Stocks

Glenview Trust, Bloomberg

According to FactSet, the financial sector was the largest contributor to earnings growth, led by Discover Financial (DFS), American Express (AXP), Progressive (PGR), and Morgan Stanley (MS). The energy sector was the biggest drag on earnings growth for the S&P 500 last week, with earnings forecasts for Chevron (CVX) and Marathon Petroleum (MRO) being cut sharply, bringing the energy sector’s forecast to -0.1% YoY, down from +13.3% YoY at the start of earnings season.

Revenue growth by sector in Q2 2024

Glenview Trust, FactSet

Sales growth is closely tied to nominal GDP growth, which combines economic growth adjusted for inflation (real GDP) with the inflation rate. Nominal GDP growth in the first quarter is expected to be strong year-over-year, which should provide a boost to corporate sales growth. At this point in earnings season, sales growth is in line with expectations.

Sector sales growth rate in Q2 2024

Glenview Trust, FactSet

So far, actual blended earnings performance has beaten end-of-quarter expectations. Combining actual results with consensus expectations from companies that have yet to report, quarterly blended earnings growth comes in at +9.7% YoY, beating end-of-quarter expectations of +8.9%.

S&P 500 Earnings Forecast

Glenview Trust, Bloomberg

The second-quarter GDP report due on Thursday will provide a scorecard for U.S. economic growth, along with corporate earnings. The Atlanta Fed is forecasting growth of 2.7%, while the consensus is 1.9%. The actual report will likely be below 2.7%, but could beat the consensus forecast.

US GDP growth forecast for Q2 2024

Glenview Trust, Bloomberg

A normalizing job market and improving inflation trends make the Federal Reserve the most likely scenario to begin cutting interest rates in September. The Fed will not signal any action at its end-of-July meeting, but will likely signal that rate cuts are imminent. The expected rate cuts in 2024 are two to three in total, with room for three consecutive 25 basis point (0.25%) cuts in September, November, and December.

How many Fed rate cuts are expected?

Glenview Trust, Bloomberg

Earnings season is in full swing this week, with two of the Magnificent 7, Alphabet (GOOGL) and Tesla (TSLA), reporting earnings. The Magnificent 7’s revenue growth is expected to significantly outpace the S&P 500 in the second quarter, so upcoming earnings guidance from management will likely be important. The shift to smaller companies and banks is evidence that stocks are pricing in the increased likelihood of upcoming Fed rate cuts and the avoidance of a recession.