SINGAPORE / ACCESSWIRE / July 23, 2024 / Singapore-based fintech company Ample FinTech today launched its novel programmable money technology, PBM3525. The technology allows individuals and commercial users to set and customize payment terms and logic on the blockchain without going through a financial intermediary or programming smart contracts themselves. Ample FinTech says it has applied the technology to Project DESFT, a pilot cross-border trade and payments solution backed by the Monetary Authority of Singapore and the Bank of Ghana. According to the startup’s leaders, PBM3525 is a versatile technology that digitizes a range of payment and financial tools, including bills, invoices, letters of credit, commercial paper and swap agreements.

Tokenization and distributed ledger technology (DLT) have become hotly discussed topics in the global fintech and financial innovation space. Many central banks around the world have launched pilot projects on central bank digital currencies (CBDCs), tokenized deposits, stablecoins, and DLT to explore the potential of these technologies in the digital economy, especially in cross-board payments, international trade, and supply chain finance. Project DESFT is a notable example among these central bank pilot initiatives.

In May 2024, the DESFT project completed its first cross-border payment pilot, utilizing the Singapore Dollar stablecoin and Ghana’s Central Bank Digital Currency (CBDC), eCedi. The pilot successfully employed PBM3525, an extension of “Purpose-Bound Money” technology, to facilitate cross-border transactions.

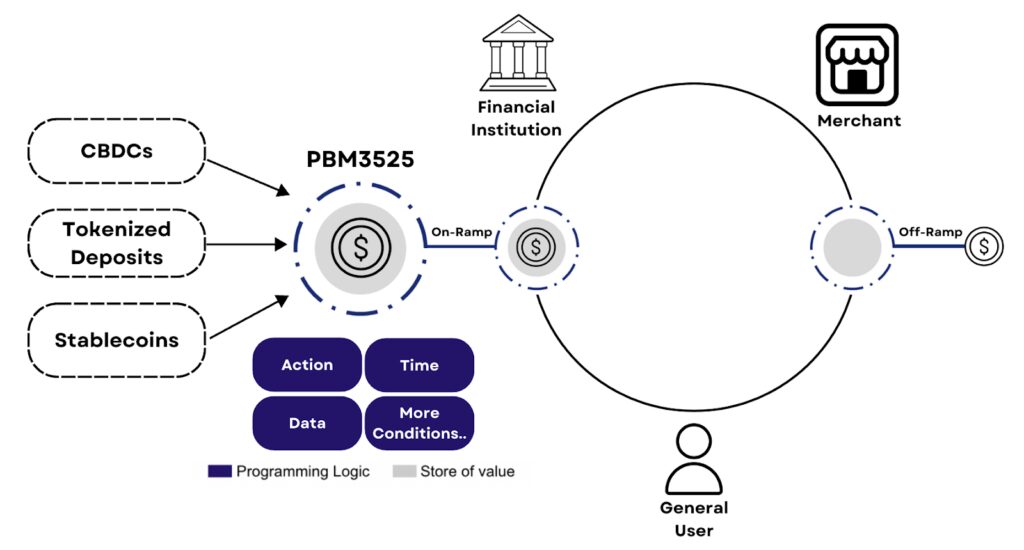

Purpose-bound money (PBM) is a new advanced programmable payment technology. Prior to this innovation, there were two main models for controlling and automating payment logic: programmable payments and programmable money. Purpose-bound money (PBM), the third and most recent model, combines the concepts and benefits of the previous two. Compared to these two models, PBM offers both the flexibility of programmable payments and the determinism of programmable money. In this new type of transferable token, the programming logic and the value of the token are tightly coupled. Technically, PBM can be thought of as wrapping programming rules around digital assets to create a new type of transferable token that contains the rules and the underlying value token. When the conditions are met, the PBM releases the underlying asset.

While the reference implementation of PBM is based on the ERC-1155 standard, Ample FinTech adopted the ERC-3525 semi-fungible token standard to create PBM and named it PBM3525, where “3525” denotes the use of this advanced token standard. PBM3525 extends “Purpose-Bound Money” technology, allowing users to create their own combinations of complex payment programming logic with simpler, more configurable, and richer visualization capabilities. With these features, PBM3525 helps commoditize programmable money technology and its applications across various industries.

David LEE Kuo Chuen, co-founder of Ample FinTech, said: “PBM3525 is a groundbreaking innovation in the field of programmable finance. The global financial sector recognizes the huge opportunities that distributed ledger technology (DLT) and smart contracts bring to transform payments and digital finance. Ample FinTech is honored to collaborate with the public sector on a pioneering project like Project DESFT, and we are pleased to have used PBM3525 technology in this project to prove the concept and execute cross-border payments. This achievement is just the beginning. A versatile and powerful technology, PBM3525 has the potential to revolutionize numerous applications, from digital finance to international trade.”

Zhexin Wan, Head of Research at Ample FinTech, is working on the next version of PBM3525 on privacy protection and compliance. He added: “PBM3525 brings a breakthrough in how digital payments are envisioned and used. By integrating digital identity and verifiable authentication technology, PBM3525 will be one of the first DLT-based programmable payment solutions that offers strong privacy protection and compliance capabilities that are essential for real-world applications. We see great potential in scenarios such as cross-border payments, international trade, trade finance, contracts, and online commerce, as it can reduce counterparty risks and costs and improve efficiency and transparency.”

This innovation marks a milestone on the journey towards the digitalization of the economy, cross-border payments, and international trade. It demonstrates that in the future, businesses and individuals alike will be able to use cutting-edge programmable payment technologies like PBM3525 without the need for expensive intermediary services. PBM3525 brings significant efficiency gains with its atomic settlement capabilities and addresses traditional cross-border payment pain points, such as long settlement times. It also simplifies international trade procedures, leverages transparency to reduce compliance costs, and increases certainty and trust in international trade. Ultimately, it will increase global financial inclusion and open up new opportunities for global economic growth and cooperation.

The successful implementation of PBM3525 demonstrates the potential of blockchain technology to transform the financial industry and foster the development of a more inclusive and interconnected global economy.

Wang Jiexin (Louis)

Email: [email protected]

https://amplefintech.com/

About Ample FinTech: Ample FinTech is a Singapore-based financial technology solutions development company working on multiple exploratory digital currency and tokenization initiatives, including Project DESFT, which is backed by the Monetary Authority of Singapore and the Bank of Ghana.

Source: Ample FinTech